Performance Update on Bitcoin ETFs: Day 15 (Patreon)

Published:

2024-02-02 16:29:11

Imported:

2024-02

Content

Negative Developments:

- Fidelity's Bitcoin ETF ($FBTC) has experienced a slowdown in activity.

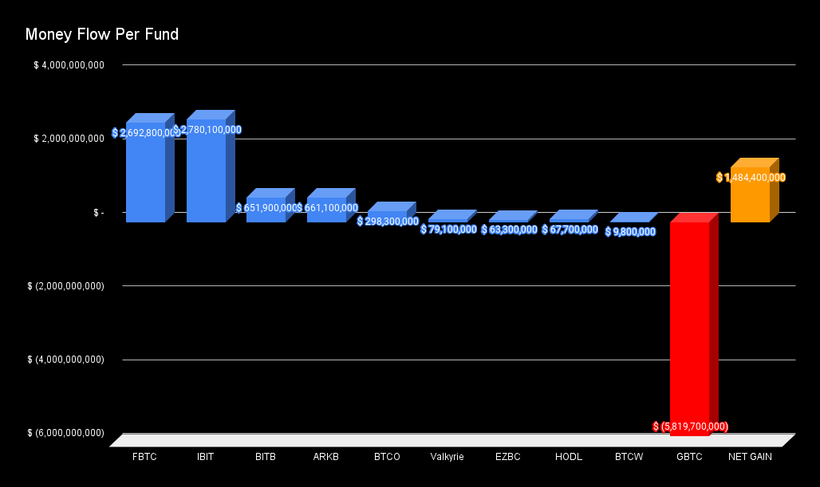

- The day marked the 7th slowest in terms of money flow for Bitcoin ETFs, with a net inflow of $40 million, indicating a mid-point in performance.

Positive Developments:

- Grayscale Bitcoin Trust (GBTC) reports stabilization with no new withdrawals in the last two days, suggesting that its worst phase may be over.

- BlackRock's Bitcoin ETF ($IBIT) has shown a significant rebound, nearly offsetting the outflows from GBTC.

- There has been a cumulative net inflow of $1.5 billion, with the total reaching $7.3 billion across all Bitcoin ETFs.

Financial Highlights:

- The 15th day emerged as the 7th largest in terms of money flow, with a significant $40 million net inflow.

- Post-GBTC adjustments, the net positive inflow into Bitcoin ETFs stands at $1.5 billion, with a noteworthy addition of over $7.3 billion in the span of 15 days.

Market Impact:

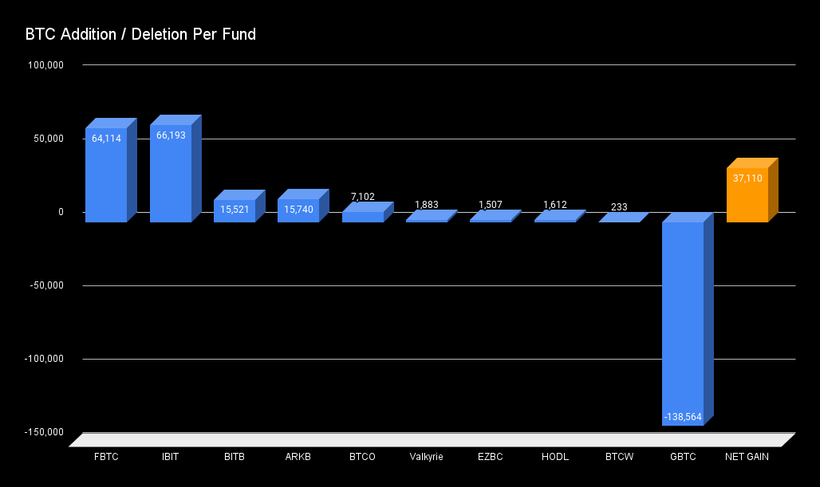

- A net addition of 37,110 Bitcoin was absorbed from the market, averaging 2,500 per day, a figure that notably exceeds the daily mining output of 900 Bitcoins.

- The new Bitcoin ETFs collectively hold over 176,000 BTC, highlighting a strong market uptake and investor interest in Bitcoin through ETF mechanisms.