BTC ETF Day 14 Progress (Patreon)

Content

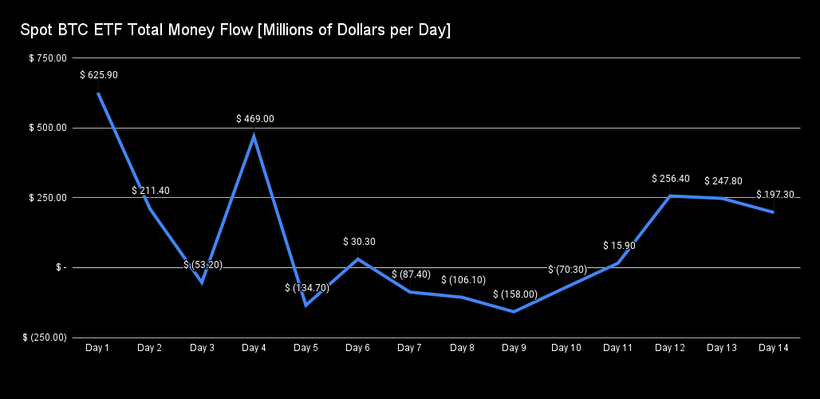

Despite what you hear... the money keeps rolling in....

BAD NEWS

1) #Blackrock $IBIT slowed

GOOD NEWS

1) ETF's had 5th best day ever

2) $200M net inflow

3) $GBTC slowed further - weakest outflow to date

4) $FBTC #Fidelity on fire

Day 14 is 5th biggest Money Day Ever in terms of money flow, bringing in $200 million net

DAY 14 MONEY FLOW PER FUND Now there is a net positive $1.44BN in ETFs after GBTC Put another way - the new ETFs added over $7 BILLION in 14 days

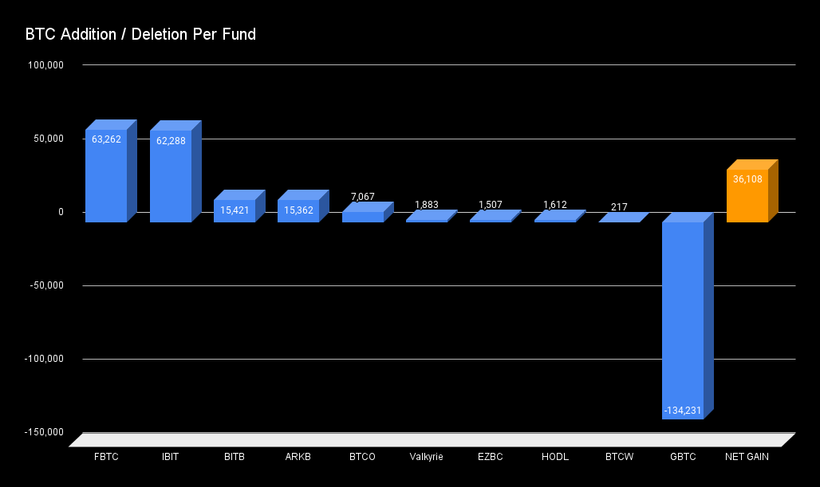

DAY 14 BITCOIN ADDITION AND DELETION PER FUND Net positive additional 36,000 Bitcoin was sucked out of the market - that is 2571 per Day - miners only mine 900 per Day. New ETFs now have over 170,338 BTC in aggregate.