Summary of InvestAnswer's Posts 25-26 Jan 2024 (Patreon)

Content

Summary of InvestAnswer's Posts

Date: 25 January 2023 - 26 January 2024 📈 - THANKS JOSH!

Tesla Sentiment:

IA expresses unwavering confidence in Tesla, considering it the most promising stock he has encountered in his entire life bar none! He was an early investor in CSCO, YAHOO, GOOG, AAPL, FB, NFLX, etc. Despite recent price fluctuations, IA remains steadfast in his belief, continually bolstered by evolving bullish perspectives on Tesla.

Trades:

IA initiated a Tesla position at $180, timing the market impeccably within 20 cents if yesterday indeed marked the bottom.

Options:

IA holds a significant number of Tesla calls across various strike prices, including the newly acquired 150s.

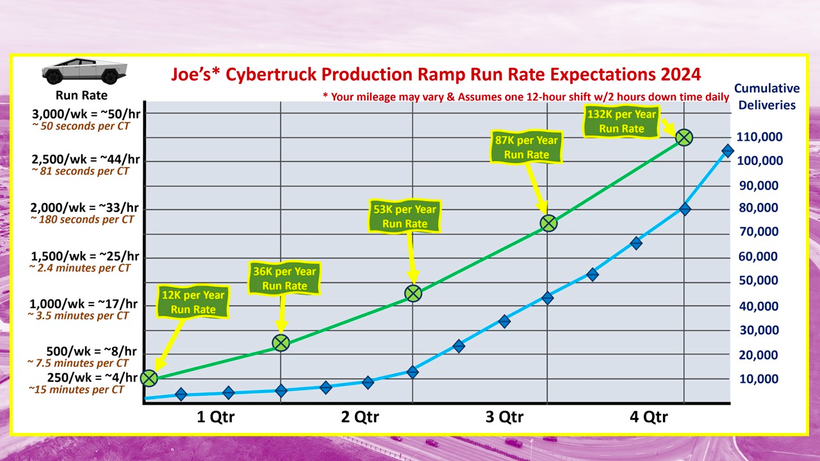

Cybertruck:

IA shares projections for Cybertruck production ramp in 2024. They will make about 105,000 in 2024 - and at year end be at a 132K run rate ramping to 250K in early 2025.

Ron Baron:

Tesla maintains its position as the top holding in Ron Baron's portfolio.

Tesla Bitcoin

Tesla is still 3rd largest corporate holder of Bitcoin (excluding Bitcoin miners)

Solana SOLALTS:

SOLALTS now constitute 9% of IA’s cryptocurrency portfolio. They have grown rapidly from 4.7%. Note IA is not becoming a degen but taking very small allocations into quality projects.

JUPITER LAUNCH

3 Days to ICO and already Jupiter is top DEX on Earth surpassing the Gorilla Uniswap

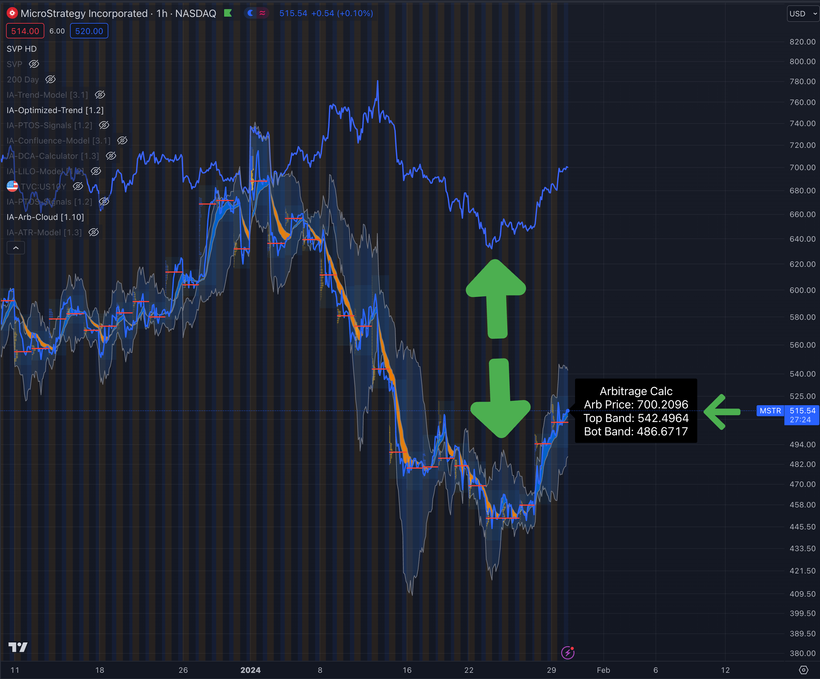

Bitcoin MSTR:

MSTR exhibits a robust rebound today. Up now $75 from the bottom. MSTR ARB cloud is alive and well and the ETF has had no impact on how MSTR is priced. MSTR did get very frothy ahead of the ETF launch but since then back in the normal ranges.

British HODL:

Members requested I reach out to British HODL for an interview. We are setting it up as we speak. Folks want more interviews so they are in the works.

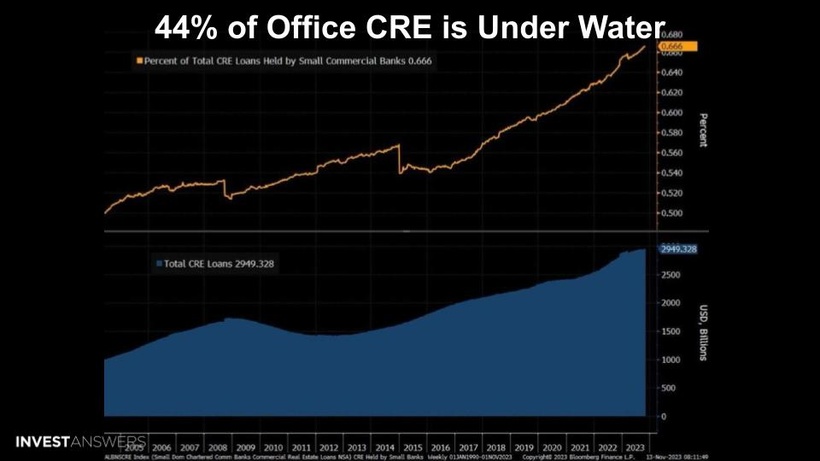

Macro Real Estate:

44% of office building loans are now in "negative equity." In other words, the debt is now greater than the property value on all of these properties. Currently, US banks hold over $2.9 trillion of CRE debt, the majority of which is held by regional banks. Office building prices are down 40% from their highs and CRE as a whole is down over 20%.

CRE is beyond bear market territory.