Summary of InvestAnswer's Posts 29-30 Dec (Patreon)

Content

Summary of InvestAnswer's Posts

Date: 29 December 2023 - 30 December 2023 📈

Bitcoin:

IA delves into the intricacies of the upcoming BTC spot ETF in a comprehensive analysis on a free Substack. IT is coming

MSTR Performance:

According to IA, MSTR is anticipated to yield a superior return on investment compared to TSLA in 2024. However if FSD or Optimus come in 2024 bets are off.

SOL Price Predictions:

IA forecasts that SOL could experience a 3x increase from its current position, potentially reaching a 5x if market conditions become exceptionally favorable. However, a repeat of the 12x surge is not expected.

David Sacks:

Contrary to speculation, David Sacks did not liquidate his SOL holdings. VC FUD is now dead.

Elon Musk:

In 2023, Elon Musk reclaimed his position as the world's wealthiest individual.

Trading:

Trade Alerts:

IA is dedicated to keeping the community informed about his actions, whether loading or hedging securities or cryptocurrencies. Every movement posted in real time.

Bitcoin Spot ETF Approval:

Speculation is growing that the SEC might notify issuers of approval for a January 10th launch as early as Tuesday or Wednesday. IA doubts it however. IA sees strong Jan for BTC.

Swaps:

IA suggests swapping GBTC for miners and MSTR, emphasizing the ease of trading MSTR compared to GBTC.

MSTR Hedge:

IA plans to repurchase his MSTR hedge at a discount on Tuesday. He is covered up to a MSTR price of $740/. This is IA arb cloud price as of today - $682 MSTR fiar price w BTC at 45K

Buys:

IA recently acquired additional BTC at $42K twice.

IA increased his SOL position at $101.21 and $100 .

Ecosystem:

SOL Alts are gaining momentum, and IA feels underweight on SOL alts despite their current size.

Hopium:

IA shares optimistic insights from Samson Mow, predicting a BTC ATH in 2024 with a price target of $1 million.

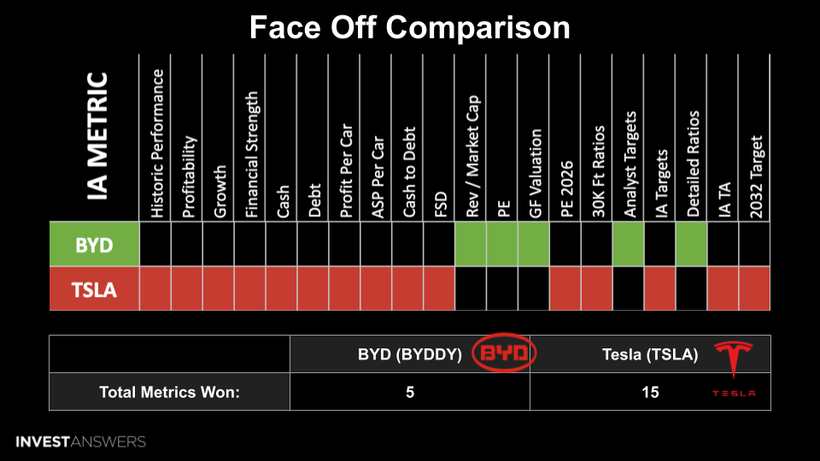

BYD:

IA expresses frustration with mainstream media promoting BYD, asserting that TSLA outperforms BYD.

Pair Trading:

IA keeps MSTR and TSLA separate, avoiding pair trading. While MSTR is riskier, IA anticipates it doubling faster than TSLA.

Option Trading:

IA only rolls options up if he is caught out short. IA then takes possession of the equity upon assignment.

ETH:

IA holds a minimal amount of ETH, having completely divested from ETHE.

2023:

IA reflects on 2023 as a mind melting year, emphasizing the difficulty of achieving another 10x year following a substantial base increase. 10x followed by a 10x turns 100K into 10M.