IA Holdings, Top YTD Stocks 2023 so far + Gameplan (Patreon)

Content

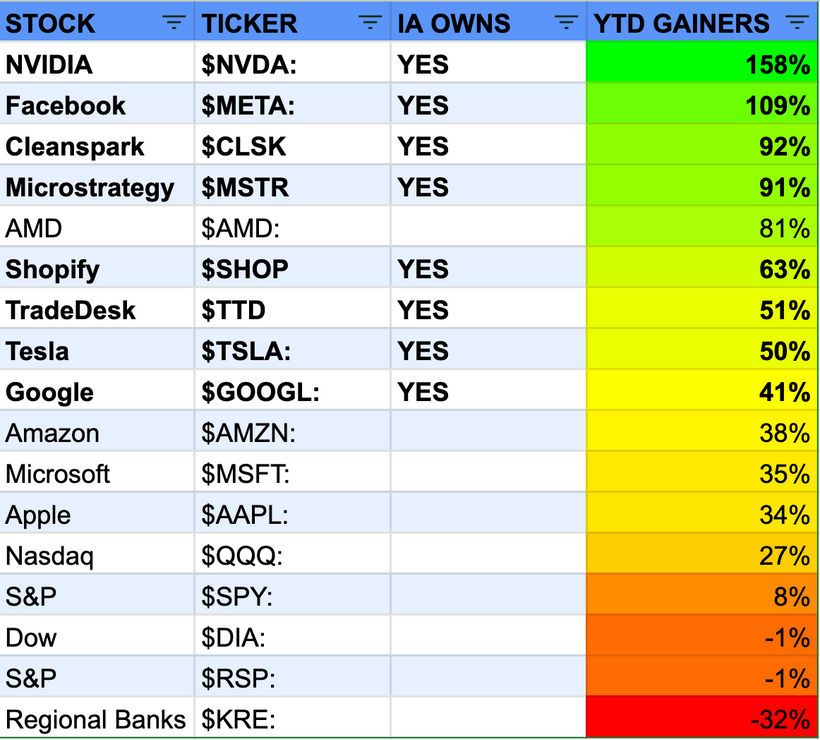

Stock picking matters

For the record these are my 8 and I am 98% in $TSLA $NVDA $META $MSTR and $GOOG - nice to see I have 8 of the 9 top performers this year.

NOTE: I did get caught out on hedging NVDA at $317.50 which means I left money on the table from the gains but I am still holding my underlying synthethic long which has printed amazing gains, along w TSLA SL's, META S's CLSK SL's

#StockPickingMatters

Note it has been an incredible year so far.... my plan is to rotate into Crypto as many of these are at tops or beyond tops.

Also note based on NVDA it shows how undervalued #Tesla is.

Also #BitcoinProxies will be fun over the next 12-18 mths