"Compounding - eighth wonder of the world" Einstein (Patreon)

Content

Hey Team

People were surprised by the Tesla video today.

One thing I want to get across.

Albert Einstein is often quoted as saying that "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." This quote highlights the power of compound interest, which is the process of earning interest on your interest. Over time, compound interest can have a dramatic impact on your wealth.

Tesla is a company that has the potential to grow its earnings at a continually high rate. This could have an exponential impact on its stock price. What makes Tesla special is that it has a number of high-margin businesses, including electric cars, full self-driving (FSD) software, robots, megapacks, and insurance. I focus on companies that can continue to grow their earnings rapidly, as this will reflect in their stock price over time.

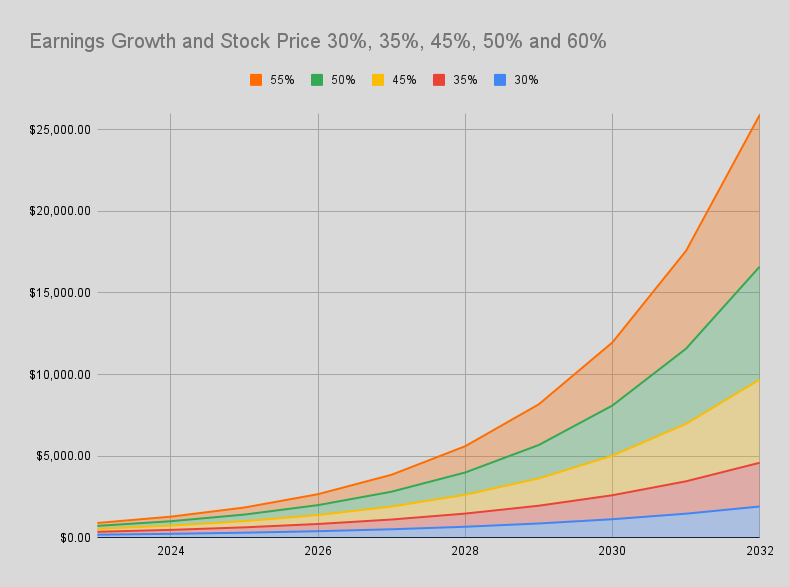

This chart here highlights that eg if they can grow earnings by 50% thru 2027 Stock Price will go to $911 and $3075 by 2030. This is the game!!!! This is the impact of high earnings growth.

Another view based on the color code of earnings growth.